Hi, I'm Keith.

Analysing, understanding & investing in the financial markets - is my passion.

I love bringing market ideas to life — with thorough research & clear communication.

I enjoy this pursuit — and I would love to share more with you about myself.

RESEARCH

Opinions on The Market — presents selected research from my journey towards better understanding the financial markets.

Some of my research works...

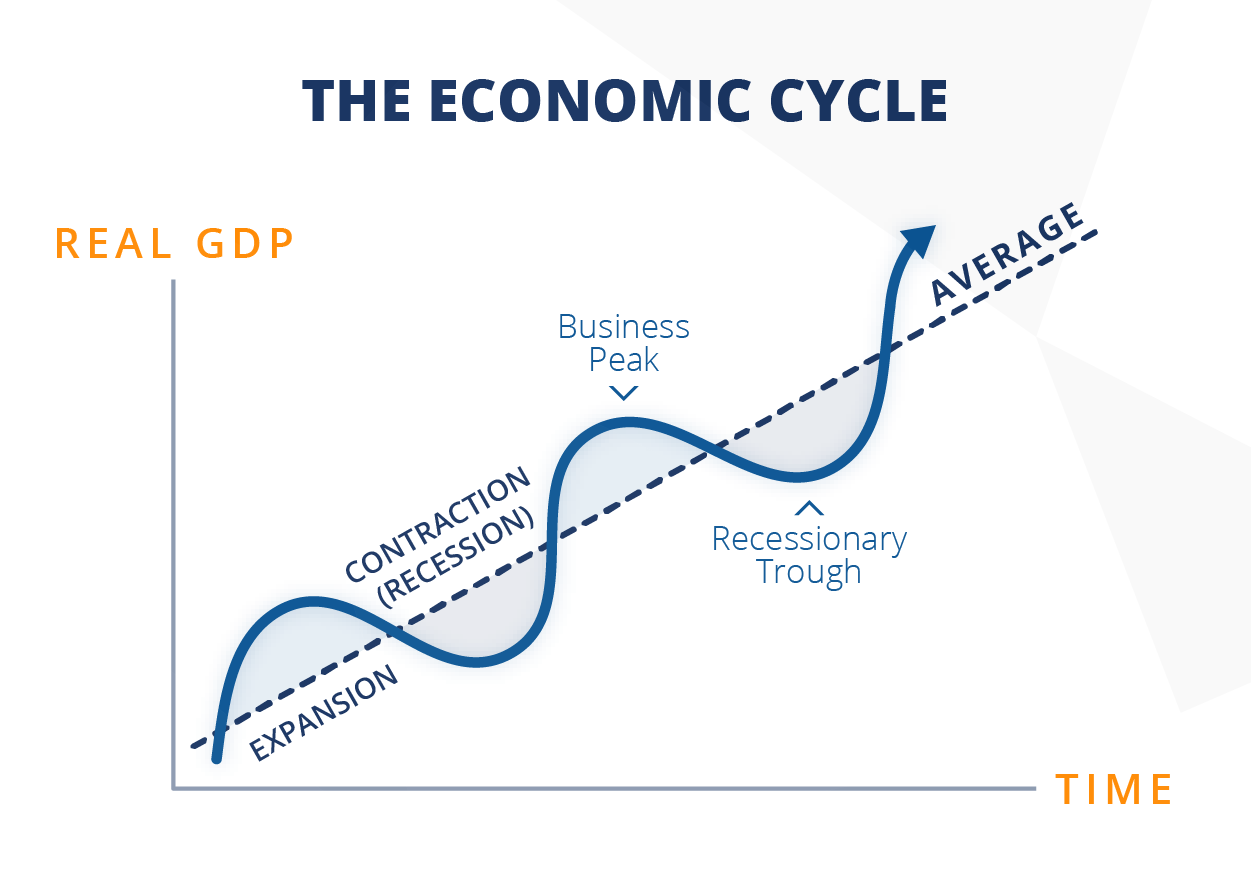

The Business Cycle Approach to Asset & Sector Allocation

Business cycles are a hallmark of the modern economy. Historically, asset and sector rotations have consistently accompanied cyclical fluctuations in the economy – some more obvious than others. Viewing investing through the lens of business cycles not only provides alpha-capturing opportunities, but also helps to avoid portfolio exposure to cycle risks.

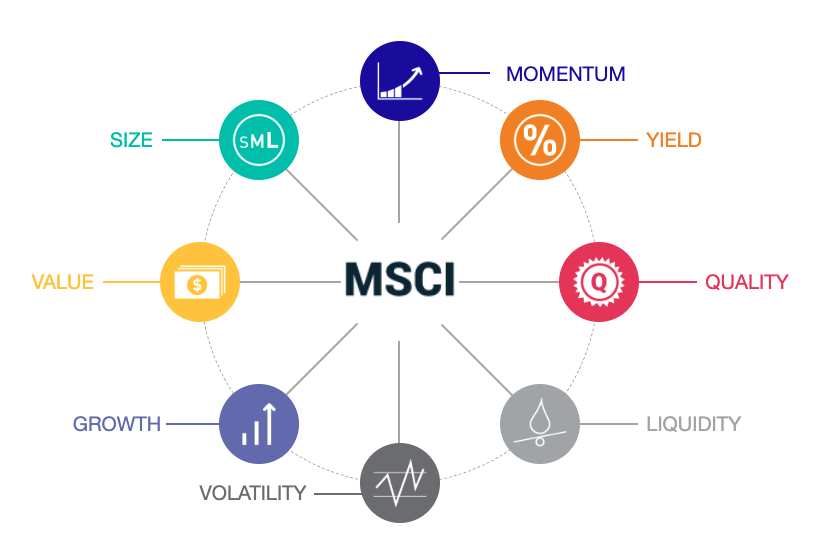

Factor Investing: A factor-based approach to investing & portfolio construction

As of Dec 2022, factor-based strategies have amassed more than $1.8 trillion in assets. Understanding how they work can provide insights to investment management. This paper presents an overview of factor investing, including – (1) a brief history of factor investing, (2) key factors, (3) factor cyclicity, (4) factor-based portfolio construction, and (5) smart beta ETFs.

2024 Fed Rate Cuts: Portfolio & Investment Ideas

As a September Fed rate cut grows increasingly eminent, now is an apt time to look at portfolio & investment strategies to capitalise on a lower rate environment.

Fed in 2024: The Past, Present & Future

As the Fed embarks on a new phase of cautious rate cuts, it is a fitting time to revisit its colourful history, present workings & what lies ahead.

About Me

Hi, I'm Keith — an undergraduate in Computer Science & Business Analytics at Nanyang Technological University. I've always loved tackling complex issues — taking on numerous internships in data science & artificial intelligence.

When I was at MODEC (an oil company) — I had the opportunity to engineer many data solutions for the financial hedging team. At the same time, I joined a NTU research programme that developed machine learning algorithms for equity trading.

These experiences sparked my interest in the financial markets & made me realise this is where I want to pursue a professional career.

Since then — I've completed the Chartered Financial Analyst (CFA) Level 1 exam (pending results), wrote numerous research articles on investment management, and furthered my proficiency through research papers, books, news articles & certifications such as the Certified Financial Modelling & Valuation Analyst (FMVA).

I am excited to continue pursuing learning opportunities, improving my skillsets & expanding my horizons in the field of investment management.